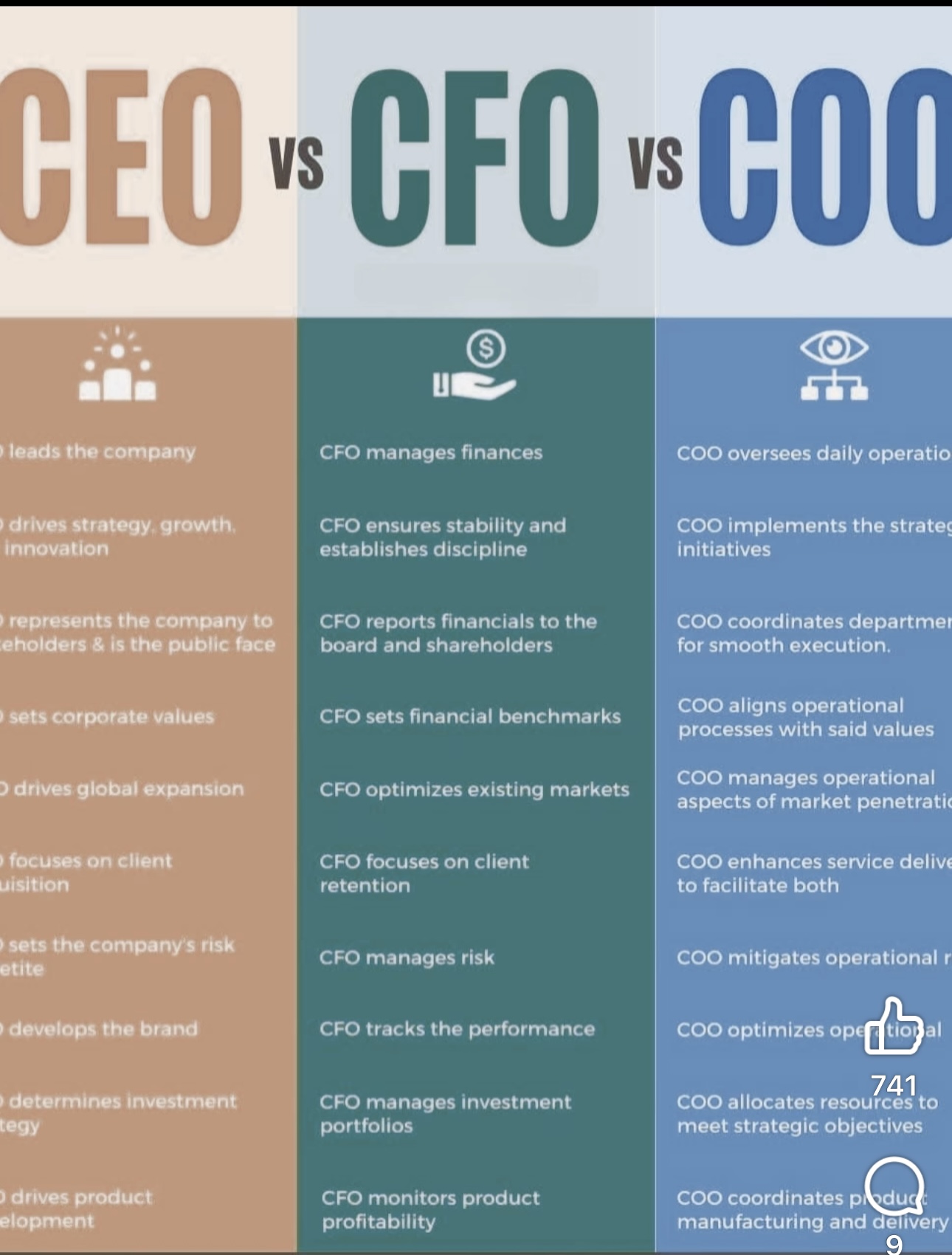

CEO vs CFO vs COO

1. Their Main Leadership Roles

CEO leads the company

CFO manages finances

COO oversees the day-to-day operations

2. On Strategic Vision

CEO drives strategy, growth, and innovation

CFO ensures stability and establishes discipline

COO implements the strategic initiatives

3. What Are Their Stakeholder Relations?

CEO represents the company to stakeholders and is the public face

CFO reports financials to the board and shareholders

COO liaises between different departments to ensure smooth execution

4. Their impact on the Company’s Values & Benchmarks

CEO sets corporate values

CFO sets financial benchmarks

COO ensures operational processes align with these values

5. Their Role in the Market Strategy

CEO drives global expansion

CFO optimizes existing markets

COO manages operational aspects of market penetration

6. What is their Client Focus?

CEO focuses on client acquisition

CFO focuses on client retention

COO enhances service delivery to facilitate both

7. Their Involvement with Risk Management

CEO sets the company’s risk appetite

CFO manages risk

COO mitigates operational risks

8. Their Relation to the Brand

CEO develops the brand

CFO tracks the performance

COO optimizes operational efficiency to uphold the brand promise

9. Their Role in Investments

CEO determines investment strategy

CFO manages investment portfolios

COO allocates resources to meet strategic objectives.

10. Their Involvement in the Product Lifecycle

CEO drives product development

CFO monitors product profitability

COO coordinates product manufacturing and delivery